On April 7, the Board of Governors discussed a proposal to combine UBC’s fossil fuel-free fund, the Sustainable Future Pool, with the Main Endowment Fund — a change that would leave donors without a fully-sustainable investment option.

Although in the process of divesting, the Main Endowment Fund — the central pool of investments for the university — still holds assets in fossil fuels.

The merge will not detract from UBC’s commitment to divestment, according to VP Finance & Operations Peter Smailes, who proposed the merge.

After debates around financial and environmental transparency, the motion was deferred to the June 21 meeting.

What is the Sustainable Future Pool?

The Board of Governors approved the Sustainable Future Pool (SFP) in 2017 to provide a fossil fuel-free and financially stable option for donors.

“The original purpose of the SFP was to research, test, and validate investment strategies that specifically target lower carbon emissions,” wrote UBC Treasurer Yale Loh in a statement to The Ubyssey.

The SFP aims to actively lower carbon dioxide emissions through investments in renewable industries and green bonds which finance sustainability-targeted projects such as public transit and renewable energy.

“It was the first step to understand the financial impact that enhanced Environmental, Social and Governance (ESG) measures would have on UBC’s endowment,” said Loh.

The case for merging

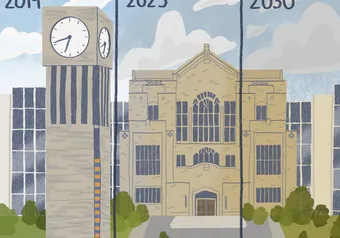

As the Main Endowment Fund will be divested from fossil fuels by 2030, proponents of the plan argue that UBC no longer needs a separate fund.

“With the commitment by the UBC Board of Governors to divest the Main Endowment Pool and lower carbon emissions by 45%, the elimination of the SFP as a separate endowment has been recommended to reduce reporting and administrative costs and burden,” wrote Loh.

Since the SFP is reported separately, it requires extra time, money and paperwork — Loh said the merger would simplify this process.

At the meeting, Board of Governors chair Nancy McKenzie said that the goals of the two funds are “aligned at this point.”

Donor acceptance, student concern

The SFP currently has only three donors and according to Loh, the donors have been consulted about the merger and have not expressed any issues.

The SFP’s spend rate is significantly lower because its investment options are more limited by sustainability requirements. Smailes said this may be why so few donors are invested.

Max Holmes, Board of Governors member and fifth-year arts student, questioned whether more publicity for the SFP might increase donations.

“We haven’t yet started a major funding campaign which would let us know if there is enough donor interest in the fund,” said Holmes.

“Personally, if I were ever in a position to donate money to this University I would only ever donate to a fully divested fund like the SFP,” said Holmes. “I imagine that many young alumni would share this position too.”

Lack of transparency around divestment

The merger would not impact UBC’s divestment timeline. However, advocates from Climate Justice UBC question whether sustainable investment strategies are impactful enough.

“Ideally, the main pool would be fossil-free now, or there would at least be a really clear plan of how to make it fossil-free, and then [the merger] wouldn’t be a problem,” said Climate Justice UBC organizer and fifth-year environmental studies student Michelle Marcus.

Although UBC is in the process of divesting the Main Endowment Fund from fossil fuels, it currently remains invested in a diverse portfolio which includes crude oil and natural gas.

Sixty per cent of the Main Endowment investments are in private equities and other sources, meaning that students do not know exactly where the Main Endowment Fund’s money goes.

“It really points to issues with the lack of transparency around divestment progress,” said Marcus.

Marcus and Climate Justice UBC have been advocating since the summer for clearly-defined interim goals for divestment progress, to promote accountability. The Board of Governors has not responded to their requests.

Student organizers pointed to divestment as non-negotiable. At the April 7 meeting, the president of UBC’s Investment Management Trust Dawn Jia said that “being fossil fuel-free or not fossil fuel-free doesn’t necessarily mean they’re being sustainable or not.”

Marcus disagrees. “The idea that you can be sustainable and not be fossil-free is just ridiculous,” said Marcus. “When UBC has committed to divestment very clearly, for the investment manager to act like that’s not a fundamental priority for the university’s investments is very concerning.”

Proposal tabled — for now

The Board will discuss the proposal again at the June Board meeting after the finance team gathers more information about the financial and environmental impacts of the merge.he proposal again at the June Board meeting after the finance team gathers more information about the financial and environmental impacts of the merge.

“I hope that in the reporting back there will be a clear answer on how those interested in donating to a fully divested fund can donate to UBC, and how this option will be promoted to donors,” said Holmes.

Share this article

First online