Point Grey and University Endowment Land (UEL) residents are raising concerns that a proposed tax on luxury homes could displace UBC student renters — but experts and officials disagree.

Westside Vancouver homeowners have recently been protested an incoming provincial tax increase of 0.2 per cent on properties worth more than $3 million and 0.4 per cent for those over $4 million, calling it unfair. Now, some are implying it could affect students too.

In an interview with The Ubyssey, UEL representative Tamara Knott said she believed that the costs of the tax could “trickle down” to students renting suites and houses in the Point Grey area, as landlords either sell their properties or increase rent to cover its costs.

“People who can afford this tax will likely not be renting out suites,” said Knott. “Most of the houses on the UEL rent out to students, and that will be going away when someone buys our homes.”

A UBC survey conducted in 2014 found that 57 per cent of students live west of Arbutus, making the Point Grey neighbourhood and other westside neighbourhoods an important part of housing for students. A 2009 UBC housing study also predicted that relative rental supply to the number of students would shrink over time.

Point Grey MLA and BC Attorney General David Eby, a proponent of the tax and the prime target of homeowners who oppose it, agreed that the student rental supply in his constituency is shrinking, but connected this to speculation and increasing development rather than the new surtax.

“The issue in our community has been that housing values — and land values more importantly — have gone up over 400 per cent over the past ten years,” said Eby. “It’s just when I look at that 400 per cent compared to the 0.4 per cent tax, I can’t fathom that the tax is somehow the issue.”

Data sourced from the Canadian Census does indicate that some properties in Point Grey have seen total value gains of over 400 per cent from 2005 to 2017, although most are below that figure.

Eby also agreed that rental rates for students are and will likely be increasing, but attributed this to landlords increasing the rent on fixed-term leases rather than tax pressure.

“This is something that’s been happening in our community,” he said. “We’ve been losing a lot of student housing as its been acquired by speculators and replaced by new homes are vacant.”

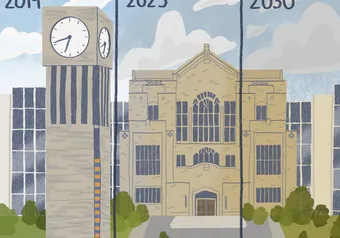

As the representative for the UBC area, Eby advocated for expanding provincial funding streams for student housing on university campuses, which he sees as a partial antidote to the “over reliance” on a shrinking supply of rental spaces like basement suites and divided houses in Point Grey.

“UBC students have had a really hard time finding housing, and they’re paying higher and higher rents,” said Eby. “If we can get students into student housing on campus, there are two big benefits. First is that it eases the burden on the transit system and people aren’t commuting in in cars. The other is that it’s reliable, affordable housing on campus, which is where students want to be.”

Sauder professor Thomas Davidoff, a housing economist who was also criticized by protestors after supporting the new tax, said that the tax might actually encourage homeowners to create more rental supply.

“As a homeowner, ideally, you don’t have anybody sharing your home with you — even if it’s a basement,” said Davidoff. “But if the tax becomes onerous then you might think about it. In that way, I would think that if you don’t sell, you would be more likely — not less likely — to rent out units.”

Even if homeowners sell — which Davidoff acknowledged might temporarily displace some housing supply — he said they’ll likely sell to developers aiming to create denser living options.

“In the long run, I would view this as a pro-student measure,” said Davidoff.

Share this article

First online